The NSW Government has been addressing tax reform for the arts. It has been a long time in coming. But the consultation and comments process is over, and the government has released a summary of submissions.

Penelope Benton, Executive Director of NAVA, says of the document: ‘This is the most momentum we’ve seen on tax reform for the arts in decades.’

More than 80 ideas for reform were raised through the submissions and fall into four themes:

- safeguarding the sector

- supporting artists and creative workers

- unlocking giving

- growing audiences and engagement.

So what are the reforms on the table?

In this story:

Tax Reform: artists voices are being counted

307 submissions were received in over the Art of Tax Reform consultation period, with more than one in three (35%) coming from the visual arts.

Benton says: ‘That’s a clear message: the current tax system isn’t working for artists, and reform is long overdue.

‘It’s taken time to get here, but the conversation has shifted. Artists have shown up, spoken out, and offered real solutions. This is what policy change looks like, and it gives me enormous hope for what’s next.’

Tax Reform: what’s in the summary for visual artists?

NAVA has done the hard work on this topic for visual artists, and it’s heartening that many of the advocated for ideas are in the summary considerations for discussion.

Among the wins that are now on the table for change, are:

- Removing income tax from art prizes, fellowships and government grants which 44% of submissions supported.

- Exempting professional artists from Non-Commercial Loss (NCL) rules, which block expense deductions for those earning over $40,000 in other work.

- Introducing averaging for GST thresholds to address harmful spikes triggered by one-off awards or commissions.

- Exploring levies on AI developers to remunerate artists whose content is used to train generative AI models.

- Broadening deductible expenses, including home studios, childcare, and travel to Country and engagement with Elders for First Nations artists.

Benton adds, ‘We’ve been advocating for these changes for years. Now they’re finally on the table’.

She continues: ‘Tax settings should enable creative practice, not penalise it. If enacted, these reforms would reduce financial pressure, improve income security, and help artists build sustainable careers.’

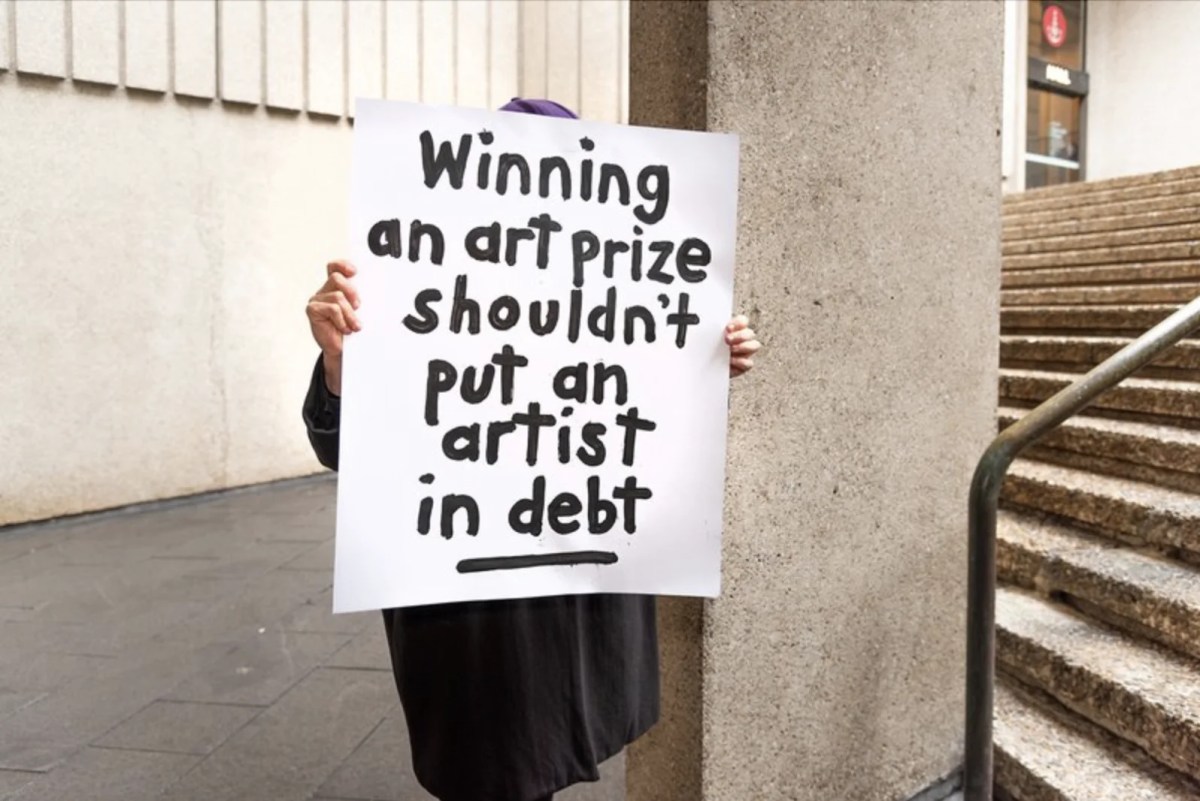

Benton makes special note of the suggestion being considered within the reforms, to removed the taxing of grants and prize money for artists.

‘Taxing art prizes like regular income ignores the reality of how artists work. One-off prizes can distort annual income, triggering GST registration, HELP debt, and significant tax bills that outweigh the prize itself. Instead of helping artists thrive, the current system can leave them worse off,’ says Benton of the antiquated realities of the current system.

‘Artists are sole traders, small business operators, cultural workers and innovators – yet the current tax system penalises them at almost every turn.

‘Artists aren’t asking for special treatment, they’re asking for reasonable and realistic tax settings that reflect the nature of their work.’

Read: You’re killing me: tax reform for artists is needed now

Tax Reform for the wider sector

Among the comments, Michael Cassel Group says in the summary that we need to make it easier for investors: ‘Australia’s investor pool for theatre is extremely limited. Contributions to the arts are largely philanthropic, which, while vital, does not build the foundation for a robust commercial industry. To truly unlock the potential of Australian theatre, we must make commercial theatrical endeavours attractive to investors.’

Some of the suggestions to navigate change include:

- A refundable tax offset for expenditure on the production of live performances.

- A refundable tax offset for exhibition production costs for galleries and museums.

- Broaden the range of deductible expenses for artists and creatives.

- Raise or remove the $40,000 NCL cap.

- Allow landlords charging below-market rent to artists and creatives to claim the difference as a tax deduction.

- Allow art and creative not-for-profit organisations to access enhanced Commonwealth FBT concessions.

- Increase the tax deduction for donations to arts and culture (e.g. a $100 donation gives a $150 deduction).

- Amend the GST non-commercial activities concession so that tickets sold by cultural not-for-profit organisations are GST-free at a higher threshold than the current 75% of the cost of supply (e.g. 90% or abolished).

- Amend Self-Managed Superfunds (SMSF) rules to permit artworks owned by the fund to be displayed in the member’s home or business premises. Prior to 2011 reforms, there were leasing provisions that allowed for this.

- Adjust the rates around Private Ancillary Funds (PAFs)

There were also a number of savvy levies that were raised to create funds to support the arts.

The Art of Tax Reform: what next?

The Art of Tax Reform Summit will take place on Thursday 25 September 2025 to further discuss these outcomes and develop key ideas of reform. A report will then be delivered on the key reforms to carry forward.

However, there is no published date for these reforms to be enacted.

Discover more arts, games and screen reviews on ArtsHub and ScreenHub.