Given the sometimes erratic nature of working in the creative industries, few graduates can visualise retiring from an arts career as a senior with retirement savings. But with foresight and care, it’s easier than you think to build up your superannuation – especially if you’re attentive to financial affairs at the start of your career.

Unfortunately, many of us don’t think about our superannuation until later in life, though this is not an issue unique to the arts.

‘When someone starts their career they’re excited, they’re focused on producing good work, finding clients and jobs, and at that point in their career their retirement is certainly not the first thing they’re thinking about,’ said Erick Cordero, General Manager, Growth at Media Super.

Get it together

The reality is that many students and graduates already have superannuation funds established for them – often more than one, given the transient nature of employment for young adults.

‘Typically many students have had multiple jobs already, working part time to keep afloat, so many would find themselves with multiple super funds because they’ve been in and out of work while they’ve been studying.’

The average Australian has at least three super accounts from this trail of jobs and the first thing Cordero recommends is amalgamating them – as quickly as possible.

‘We’re quite lucky in this country in that we do have compulsory super and it’s important that people understand that their employers are paying at least 9.5 per cent of their wages into a super account. It’s your money, so understand what account it’s going into,’ he said.

Learn more about your superannuation

‘As you change jobs and go from one job to the other, you tend to accumulate a number of accounts. So the first thing is to bring all those accounts together and ensure that you’re maximising what you have.’

Amalgamating your super means you won’t be charged multiple account fees and potentially multiple insurance premiums.

‘The way I explain it is, people wouldn’t have multiple gym memberships, so why have multiple super accounts?’

The freelance trap

In the creative industries there’s often the additional challenge of managing one’s own finances through a range of serial jobs, freelancing gigs and temporary roles.

‘For arts and entertainment workers it can be complicated because if you’re self-employed or freelancing, it’s often up to you to put money into your own account – though not always, it depends on the nature of the contract. You may be eligible for super from your employer,’ said Cordero.

‘If you’re not sure, the ATO have got a handy decision tool online that helps people navigate whether super’s included in their contract or not.

Time is your friend

In the first few years of your arts career, time is your biggest ally; your career will span decades, giving you plenty of time to contribute to your own nest-egg.

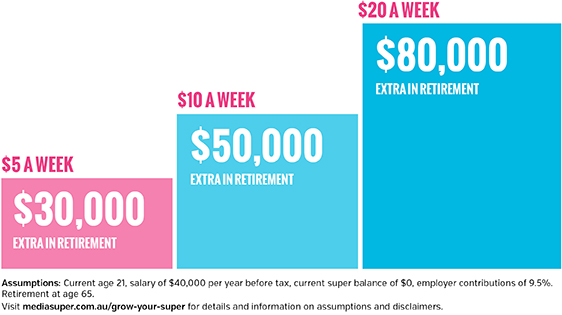

‘If people add a little extra a week to their super account, that can make a significant difference over time. Those small amounts add up, and through the power of compound interest over 30-40 years, you could see a big difference when you do reach retirement age,’ Cordero said.

‘So we would recommend that people firstly ensure that they are getting that super contribution added to their account, and wherever possible consider adding a little bit each week. Talk to your employer about setting up salary sacrifice or after-tax contributions, or look at setting up a direct debit.’

Think about super at the start of your career

While time is on your side, it’s also wise to consider whether or not you’ve taken up the right investment option.

‘The majority of people will have their money in a “default investment option”, which is usually a “balanced” option; but depending on your circumstances there may be a better option for you. Generally, younger people can afford to take more risks because they’re investing over a longer period of time, so they may want to invest in a growth option.

‘We would certainly recommend that they have a think about their options and give us a call to see what the right investment option is for them. It’s a change that could make a significant difference to their super balance when they retire,’ said Cordero.

Co-contributions and conversations

The Federal Government can also help you grow your superannuation balance, Cordero explained. ‘The government actually encourages additional contributions through what they call a government co-contribution. This is where you add a little bit to your account and depending on how much you earn, the government will contribute part of that amount into your account, up to $500 a year.’

While navigating the world of superannuation might seem challenging, it’s easier than you think. And of course the experts are always happy to help.

‘We encourage people to give us a call or go to our website – we’ve recently added a page for young artists and workers that runs through the basic steps for getting their super sorted. Plus there’s a suite of 90 second videos to help them take the next steps.

‘So we would recommend people visit the website and give us a call if you have questions or just want to talk it through,’ Cordero concluded.

For more superannuation advice for students, graduates and young arts professionals visit www.mediasuper.com.au.

This article provides general information only, and does not take into consideration your personal objectives, situation or needs. Before making a decision to combine your superannuation, you should consider any penalties such as exit fees, change to insurance cover or loss of benefits that may apply and, if necessary, consult a qualified financial adviser. Before making any financial decisions you should first determine whether the information is appropriate for you by reading the relevant Product Disclosure Statement and/or by consulting a qualified financial adviser. Issued by Media Super Limited (ABN 30 059 502 948, AFSL 230254) as Trustee of Media Super (ABN 42 574 421 650).